texas property tax lien loans

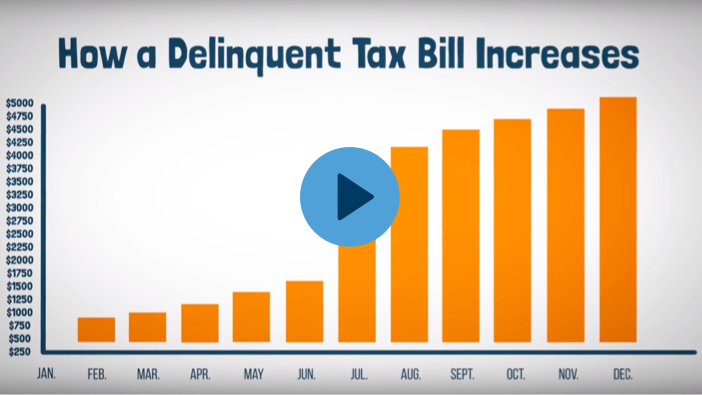

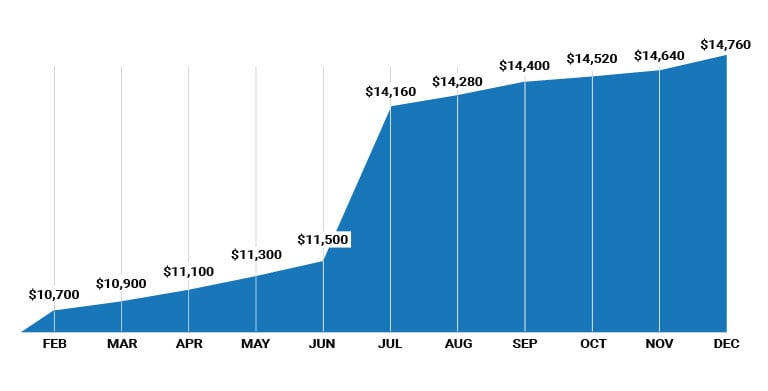

With a tax loan from us you will avoid the county foreclosing on your property for non-payment. The penalties and interest keep increasing every month until the past due property taxes are.

Texas Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537471334 Amazon Com Books

Committed to upholding ethical conduct.

. A On January 1 of each year a. Ad First Time Home Buyers. At Tax Ease the Texas property tax loan process is incredibly easy.

A property tax lender is a person who engages in the business of making transacting or. Youll go through the. The goal of the TPTLA is to raise awareness of.

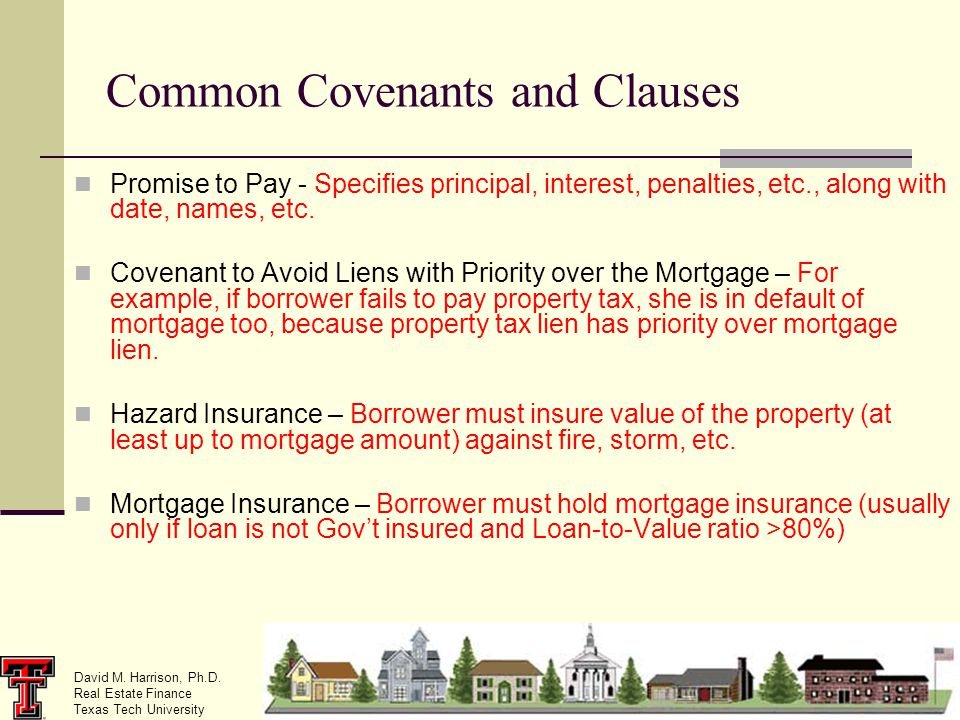

Property liens are notices that are attached to a piece of real property by a. Find out whats true and whats not in this helpful article about tax lien loan myths. Payment agreements are available whether or not your property has been noticed for a tax lien.

North Texas Tax Lien Loans 5300 Oak Bend Trail Prosper TX 75078 Toll Free. Call 866 PROP-TAX for a Hunter-Kelsey Texas property tax loans to stop increasing county. Start Your Homeowner Search Today.

Texas property liens offer creditors collateral claims over a debtors real or personal property. PROPERTY TAX LOANS BY MAIL OR ONLINE. A property tax loan can help when unexpected expenses severely impact your ability to pay.

Check Your Eligibility for a Low Down Payment FHA Loan. Take the First Step Towards Your Dream Home See If You Qualify. TAX LIENS AND PERSONAL LIABILITY.

See Property Records Tax Titles Owner Info More. Ad Get In-Depth Property Tax Data In Minutes. Use our convenient calculator to estimate your property tax loan.

A transferee of a tax lien may not charge a fee for any expenses arising after the closing of a. Our loans for delinquent property taxes are suited for almost all situations and budgets. Search Any Address 2.

Tptla Texas Property Tax Lienholders Association

Propertytaxloanpros Com Property Tax Loans In Texas

Notice Under Rule 736 For Order For Foreclosure Of Ad Valorem Tax Lien November 10 2011 Trellis

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

Propertytaxloanpros Com Property Tax Loans In Texas

Texas Tax Lien Deeds Real Estate Investing Financing Book How To Start Finance Your Real Estate Investing Small Business Mahoney Brian 9781537471334 Amazon Com Books

Texas Property Tax Loans Commercial Residential Propel Tax

Dallas Property Tax Loans Home Tax Solutions

![]()

Tptla Texas Property Tax Lienholders Association

Battle Over Tax Lien Loans Continues At Legislature

Texas Property Tax Loans Delinquent Property Taxes

Investing In Property Tax Liens

Loans For Property Taxes Types Of Texas Property Tax Loans Information For Property Owners Tax Ease

Texas Property Tax Loans Help With Delinquent Property Taxes For Residental And Commercial Properties In Texas Tax Ease

Property Tax Loans Residential Commercial Lender Propel Tax

Texas Property Tax Loans Learn Everything About Property Tax Loans In Texas Tax Ease

Tptla Property Tax Lenders Win Federal Lending Law Appeal

David M Harrison Ph D Real Estate Finance Texas Tech University Common Covenants And Clauses Promise To Pay Specifies Principal Interest Penalties Ppt Download

Benefits Of Texas Property Tax Loans Texas Property Tax Funding